UK farming profitability was under threat in 2025

18th December 2025

UK arable farmers have struggled throughout 2025 due to consistently low grain prices, Hectare Trading reports.

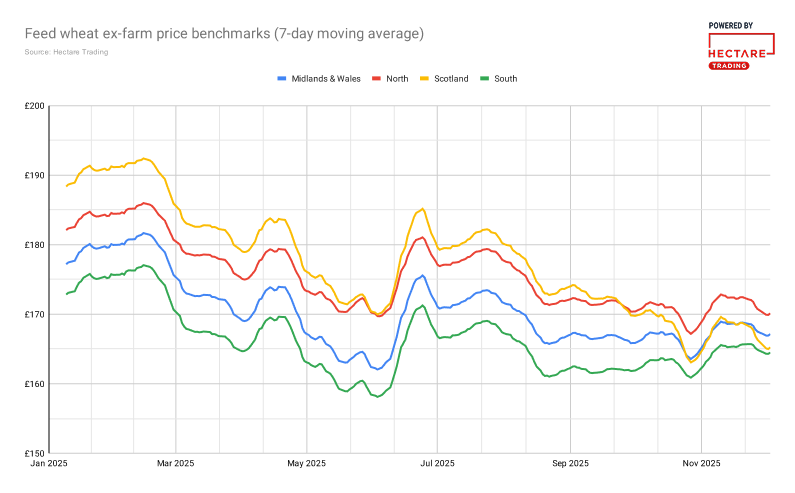

Against a backdrop of inflation and rising input costs, spot feed wheat ex-farm prices dipped to their lowest levels of the year in May (£157.02/t in the South on 30 May), based on sales on Hectare Trading.

After a brief harvest rally, the moving averages drifted downwards again into the autumn, with Scotland noting a particularly weak time compared to other regions. Following a summer of variable yields and prolonged uncertainty on government subsidies, farmers are faced with a bleak picture, the experts said.

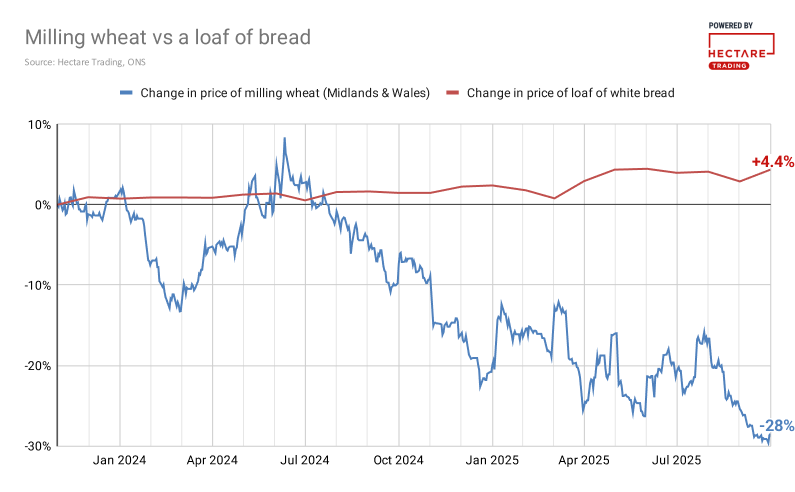

The UK cost-of-living crisis has certainly not been driven by UK grain producers, as the prices farmers receive for their crop have become increasingly detached from consumer food prices.

For example, since November 2023, milling wheat prices in the Midlands & Wales have fallen by 28%. This compares to a 4.4% rise in the price of a loaf of white bread, according to government RPI data, over the same period, Hectare Trading explained.

Farmers turn to strategic selling to improve margins

Faced with such low prices, UK farmers largely refrained from selling their 2025 crop forward before harvest. Since harvest, with few signs of improvement in the market, they have looked to forward-selling to take advantage of carry.

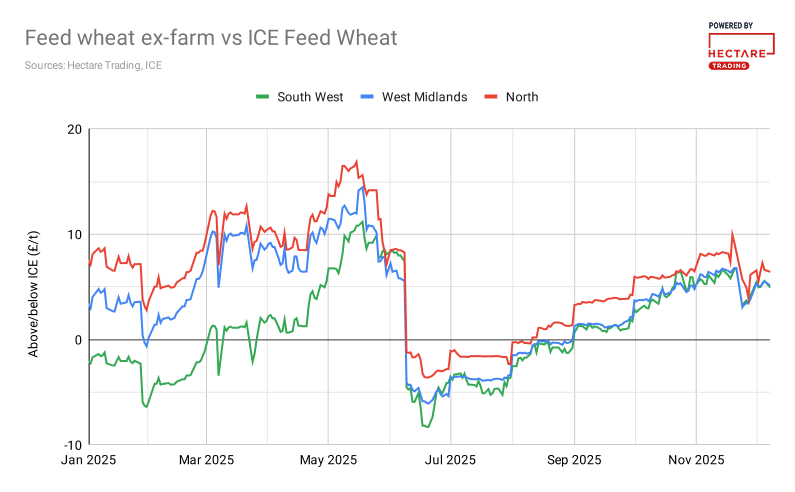

Hectare Trading’s detailed price analysis shows that regional dynamics of supply and demand can differ markedly from traditional grain benchmarks, offering significant price opportunities for strategic sellers.

On 1st January 2025, spot feed wheat ex-farm was trading on Hectare Trading at £177.33/t in the South West, £2.07t lower than the price of the nearest ICE Feed Wheat contract. On 21st November, it was trading at £169.73/t, a premium over the nearest ICE Feed Wheat contract of £6.73/t.

Comparable swings against the futures have been seen in the West Midlands and the North over the course of 2025, with all three regions trading at a premium to the nearest futures contract in the fourth quarter.

This indicates that, while benchmark prices are presently weighed down by ample supply at national and global levels, at the regional level basis movements can behave very differently, allowing cash prices to outperform the futures even in a broadly bearish market.

Hectare Trading said that to capture these regional pockets of higher demand, farmers have had to innovate in their selling practices.

More and more farmers have turned to the crop trading company as an alternative to their usual grain marketing approach. Since the start of 2024, farmers selling feed wheat on Hectare Trading have beaten the market average (i.e., the comparable AHDB Corn Returns price) 77.7% of the time.

OSR: increased production in a favourable market

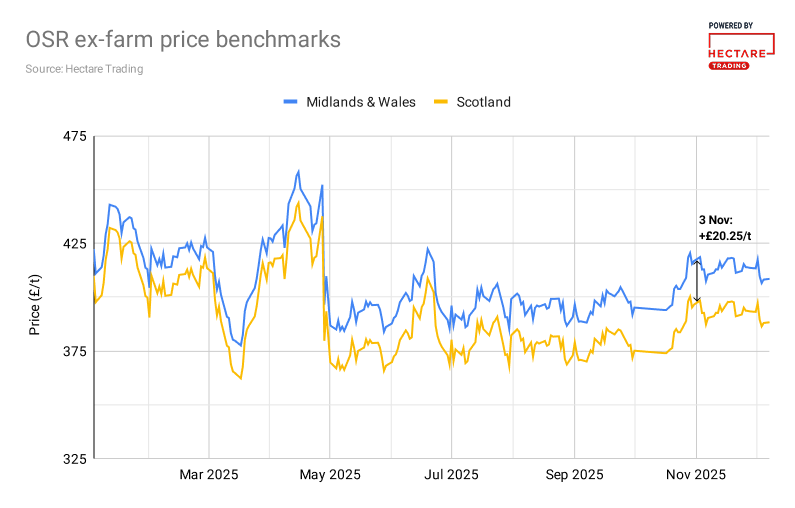

A rare bright spot this year has been the performance of oilseed rape. AHDB estimated an average UK yield of 3.7 t/ha, well above the 10-year average of 3.3 t/ha, giving rise to a 5.5% jump in production to 722 thousand tonnes.

Prices have held up well too. In the Midlands & Wales, spot OSR ex-farm prices, based on sales on Hectare Trading, hit a high for the year of £458.12/t on 15 May. Growers in the Midlands have also enjoyed a strengthening of their regional basis over growers in Scotland, with a premium as high as £20.25/t on 3rd November.

“The favourable market has encouraged a 30% increase in OSR planting intentions for harvest 2026. With more OSR on the market, we might expect to see some downward pressure on prices next year. UK farmers might consider selling their 2026 OSR forward now for harvest movement to lock in favourable prices and limit their market risk,” a spokesperson for Hectare Trading concluded.

READ MORE: Harvest 2025: Challenging year concludes with mixed results

Read more arable news.