Farmers turn to forward-selling as grain market pressures persist

23rd September 2025

With grain prices under pressure and input costs climbing, more UK farmers are turning to strategic selling to manage risk and secure margins. According to Hectare Trading, there is growing interest among farmers in selling their crop forward over the harvest period.

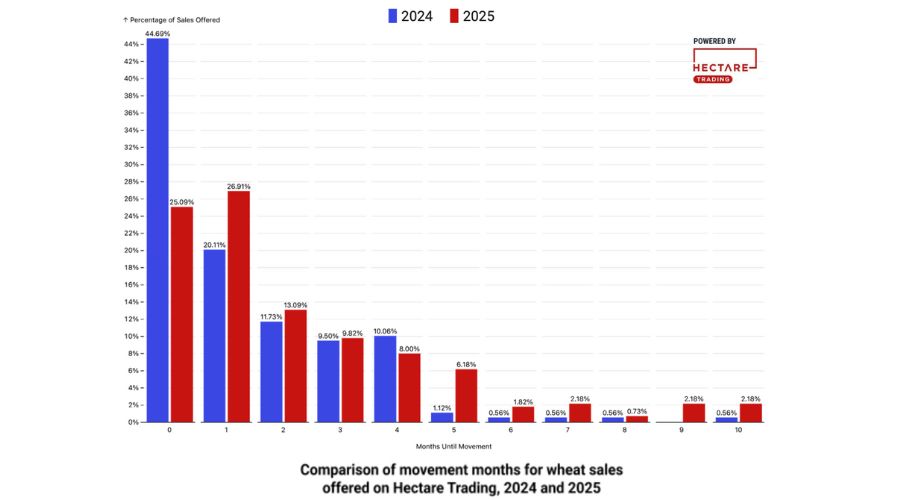

Since the start of July 2025, only 25.1% of wheat sales offered on Hectare Trading have been for immediate movement, compared to 44.7% over the same period last year, experts from the online crop marketplace confirmed.

Moreover, 14.8% of wheat sales have been offered for movement between five and 10 months further forward. This compares to just 3.4% a year ago.

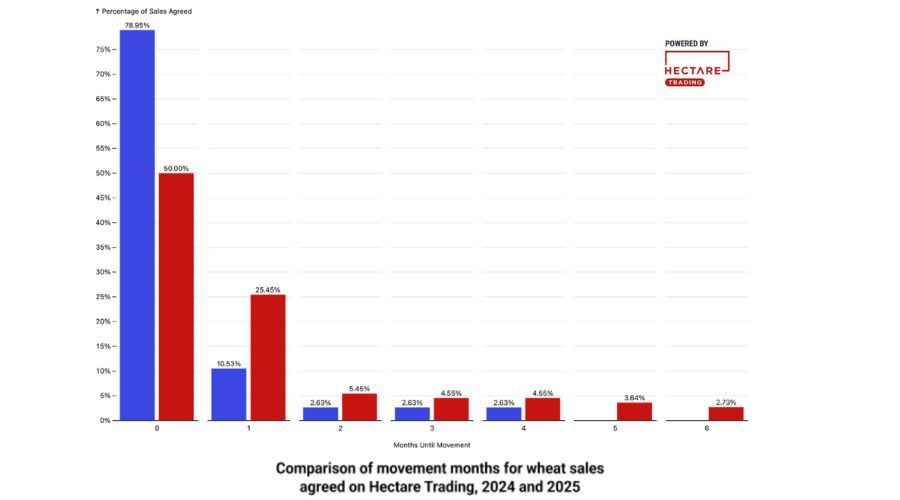

Similarly, for wheat sales agreed, only 50% have been for immediate movement compared to 79% a year ago, with again an increasing proportion of sales for forward months.

Hectare Trading said that some farmers are selling their 2026 crop before the seed is even in the ground. The last time UK farmers sold the following year’s harvest at such an early stage was in 2022, when prices were riding high following Russia’s invasion of Ukraine.

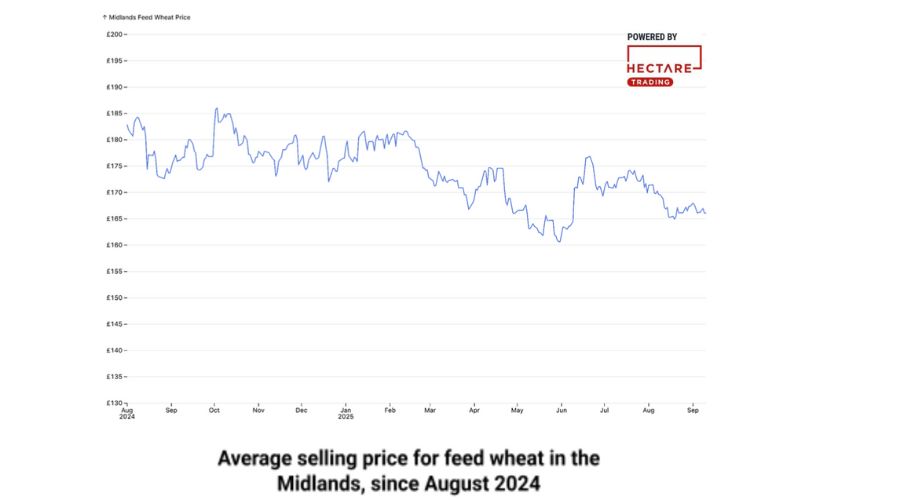

By contrast, for the past year, prices have been on a slow decline. The average price for feed wheat in the Midlands (derived from sales on Hectare Trading) has weakened from £184/t in August 2024 to £165/t in August 2025, dipping as low as £161/t in May.

Scottish regional premium for feed barley has collapsed

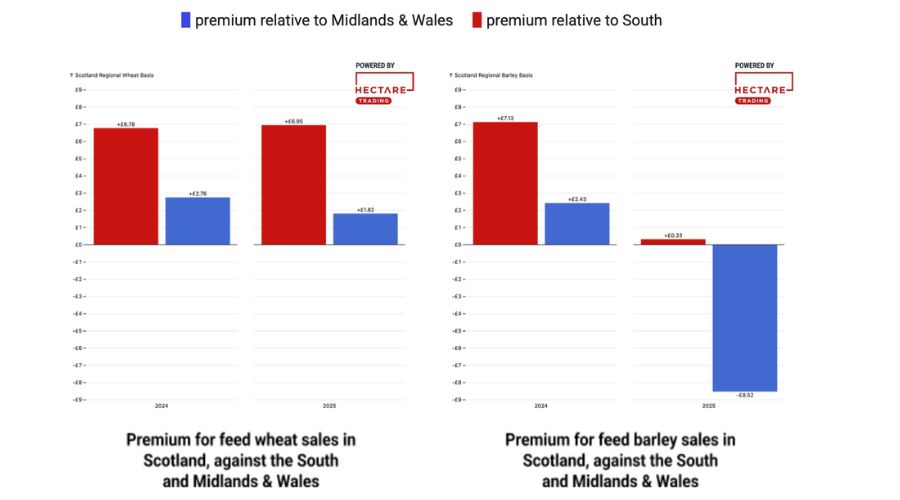

Scotland typically trades at a premium for wheat and barley, and for wheat this year is no different.

Since the start of July 2025, the average price of feed wheat sales on Hectare Trading is £1.82/t higher in Scotland than in the Midlands & Wales and £6.95/t higher than in the South.

Prices for feed barley, however, have been impacted this year by regional variances in supply and quality concerns for malting barley, as recorded in AHDB’s Harvest Progress report, potentially increasing the amount of feed barley on the market.

This means that Scotland’s regional premium for feed barley against the South has shrunk to just £0.33/t compared to £7.13/t for the same period last year, Hectare Trading experts saod.

The swing against the Midlands & Wales is even more marked, where a £2.43/t premium has turned into an £8.52/t discount.

Ex-farm spot prices in Midlands now beating futures

Barring a couple of short-lived rallies, wheat futures have weakened over the harvest period, with the UK (ICE) Feed Wheat November 25 contract ending August at £169.50/t.

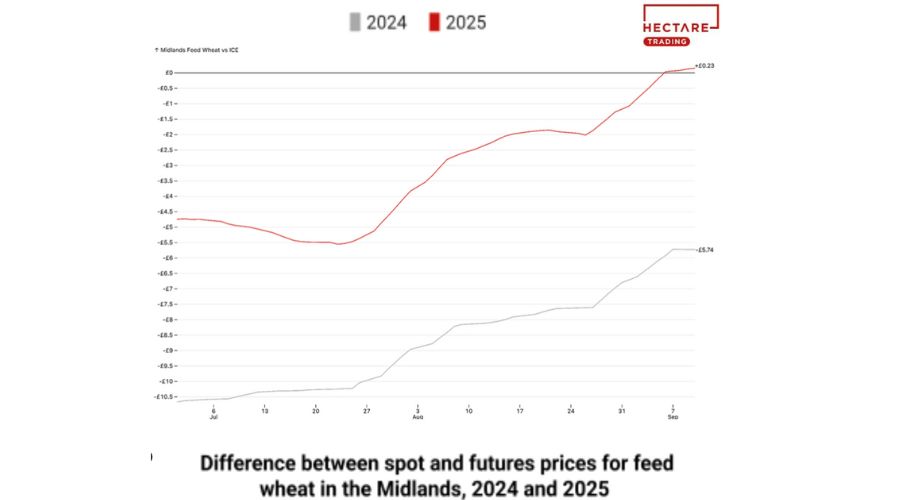

In the Midlands, the ex-farm basis (the difference between the regional ex-farm price and the futures price) for feed wheat typically lags the futures through the second half of the year, reaching parity only towards the expiry of the November contract.

This year, however, spot prices moved to parity much sooner than usual. If we track the seven-day moving average, feed wheat in the Midlands is now trading at +£0.23/t relative to the futures price, compared to -£5.74/t at the same stage last year.

Read more arable news.