Top tips to protect your farm machinery and equipment

8th December 2023

There are potential implications, both from a legal perspective and in respect of your insurance if required machinery tests are not carried out. It’s important to seek advice on farm vehicle and machinery safety to ensure you understand how you can reduce the risk of accidents happening, writes Will Oakes, CLA Insurance account executive.

It’s always important to inform your insurance broker when high value equipment is purchased and when a business diversifies or pivots to include new services. Even the simplest of changes can affect your exposure to risk.

Inspections and breakdown cover

The purpose of an inspection is to identify whether work equipment can be operated, adjusted and maintained safely. It is critical to ensure that any deterioration is detected and remedied before it becomes a risk to those operating it or a financial loss to the business.

Some of the typical machinery claims we see include:

- Breakdown and loss of revenue

- Theft

- Fire

- Injury (liability).

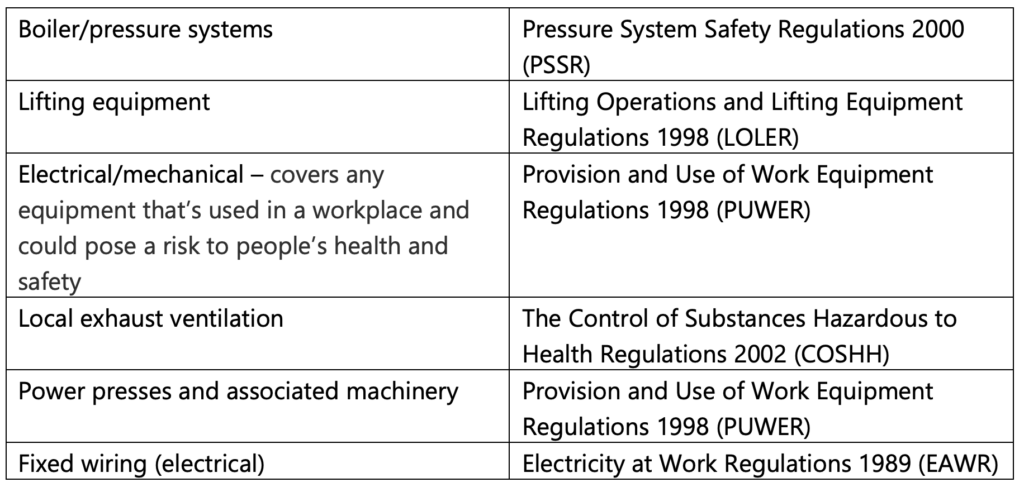

Whether your equipment requires inspection, and how often, is normally determined by legislation and what category of equipment it falls under – see below the different legislations and types of plant:

You can purchase inspection services from your insurer or broker for a reasonable annual cost and let them complete the inspections for you.

Equipment should be inspected after purchase and before first use, and at suitable intervals after that. It is also important to re-check when modifications are made.

Failure to do so can leave you uninsured and in breach of government regulations. Moreover, if anyone is injured as a result of faulty or unsafe machinery there are also severe legal implications and a threat of litigation.

Is your equipment suitably insured?

It’s important to know for certain if kit is insured under your current policy, especially when new equipment is purchased, so always check.

Some motor policies, for instance, include cover for attachments automatically – others don’t. Could you afford to replace the kit if it was lost or broke down? Would your business suffer?

Other questions to ask include:

- Do your staff have training for using the kit?

- Does the farm have a risk assessment and plan that staff and employers can follow?

Although insurance is there to cover you in the event of a loss, the best course of action is to do what you can to prevent a loss occurring in the first instance. So, ensure all farm machinery and equipment is safely and securely stored, well maintained and anyone using it is appropriately trained and licensed.