Diversification in an uncertain world

3rd October 2022

In uncertain times, Rural Asset Finance is seeing more and more farmers looking to diversify into green energy. While traditional banks which may balk at the idea of loaning money for new enterprises that have not been tried and tested, Rural Asset Finance explains an alternative funding option that is available to diversifying farmers.

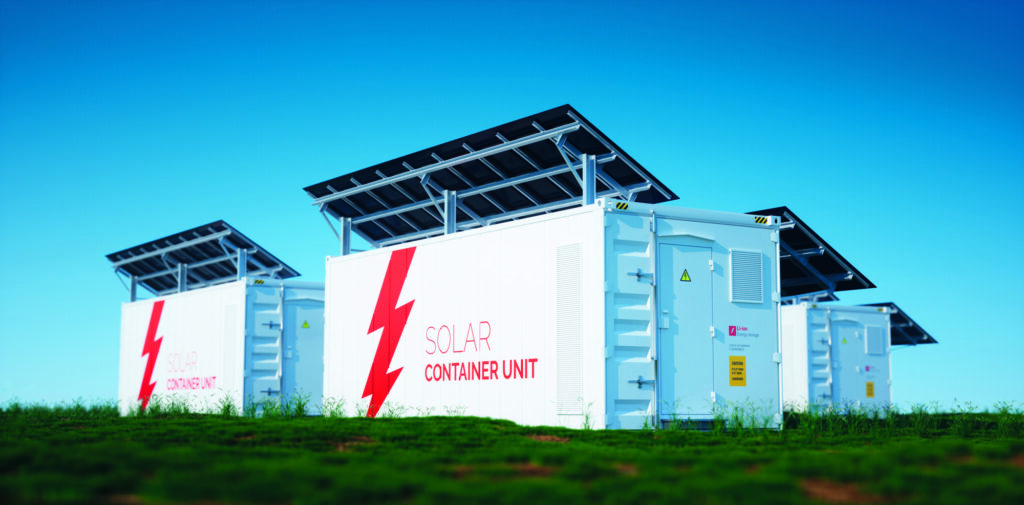

Solar container unit. 3D rendering concept of a white industrial battery energy storage container with mounted black solar panels.

Well, you can’t say our new Prime Minister and Chancellor haven’t had an impact! Their shock-and-awe approach to fixing the economy has plunged the pound to its lowest level since decimalisation, earned a censure from the International Monetary Fund and could spike interest rates to their highest level for at least 20 years.

Of course, it might just work. It’s true that the markets and many of the world’s financial experts are sceptical – to put it mildly – that Liz Truss and Kwasi Kwarteng’s short sharp shock treatment will kickstart long term growth. But their supporters are urging people to give it a chance – admitting that while there is pain, there would also have been pain in Rishi Sunak’s slow-burn austerity plans. Some suggest people are scared of the Chancellor’s radical measures only because they’ve never been tried before. While some critics suggest there may be a good reason for that.

Whatever happens in the long-term, the short-term reality is a hard winter for all – soaring energy costs, higher food prices, rising interest rates and rampant inflation will bring challenges for individuals and businesses alike – and the nation’s farmers are no exception.

Britain’s farmers are faced with a choice of priorities: grow food, feed your family, heat your house and look after the environment. How do you keep costs under control? And how do you hedge your own risks?

For many, diversification and new revenue streams are the key. The need for farmers to look for additional revenue streams is greater than ever – and it will likely only increase further in the months and years ahead.

At Rural Asset Finance we have seen first-hand the resourcefulness and inventiveness of farmers bringing in additional income and our lending has supported and enabled a vast range of initiatives, including traditional food production, holiday and tourism, green energy or environmental/ELMS based projects.

But recent events are inevitably putting food and fuel efficiencies at the top of many business’s agendas and many news outlets have reported that the government is “rapidly reviewing” its ELMS payment, and modification is on the way. Defra denies this but certainly many farmers are focusing on diversifications based around food and energy production that not only increase efficiency, but also give them the reassurance of fixed costs – hedging the risks.

For example, we are seeing more and more interest in funding solar panels and batteries, with farmers with extensive roof space keen to generate their own electricity. This wouldn’t just mean generating – and potentially selling – their own energy, but with our funding they lease the equipment on a fixed-rate, fixed-term basis and save money on the lease payments being less than the electricity bill; their cost of electricity would stay exactly the same throughout the length of the agreement. It would not matter how high energy prices or interest rates rise – they will be confident their costs would not go up for the period of the RAF lease.

Many of our farmers are already exploring green energy – we have funded major biomass and biogas plants – and others are keen to make their food production operations more efficient, so we regularly finance new buildings and precision, hi-tech machinery. Many farmers are making smart use of government innovation grants, maximising this windfall by using it as a deposit for a larger project and borrowing the remainder. Many of our clients have used the Farming Improvement Grant (which is about to enter its second allocation round) and its Farming Equipment And Technology Fund and Farming Transformation Fund as a down payment for major projects, the balance after the grant coming from a loan – thus preserving their cash flow in these uncertain times.

Solar panels on a new farm barn in The Netherlands.

Of course many new revenue streams incur major start-up costs, and many banks might balk at loaning money for a new arm of the business that is not tried and tested. But with our extensive personal experience of such projects, we take a different approach. At Rural Asset Finance we understand farms and the challenges farmers face. We look at the possibilities of the future as much as performance of the past. We can use existing land or buildings as security to open up huge possibilities for farmers to invest and create the future business that they want.

Most crucially of all, the one thing farmers (and everyone else) want at the moment is certainty in an uncertain world. After 14 years – virtually a generation – of low food costs and 1% interest rates, suddenly both are soaring and no-one knows what’s going to happen next. Certainly no-one knows how often and how high the Bank of England will raise the cost of borrowing over the next year, but it’s possible we’ll see the base rate as high as 6% in the coming months. However, farmers locking in funding now for their projects with our fixed-rate, fixed term loans will have no such nasty surprises, enabling them to budget accordingly – hedging the risks.

And with the right type of innovative diversification, they might end up cutting their food production costs and energy bills too. With our friendly support and practical help, we can enable you to take that step, making the most of those assets around you to ensure your revenue for years to come and preserve your business by hedging the major risks.

Costs may be spiralling, but there’s a clear opportunity for farmers to invest and diversify in a sustainable future, to fund food production and renewable energy in a sensible, practical way. To take control of their futures, and their finances with a fixed-rate, fixed-term plan. Literally, this could be the moment you take back the power.